Three years ago, North American CS:GO was on the rise. Cloud9 went head-to-head with FaZe Clan in the Boston Major finals and won. For the North American team, it was the first — and so far, the only — victory in a Major. The CS.MONEY Blog is here to look into reasons why it might also be their last.

What happened?

The North American Counter-Strike: Global Offensive pro scene failed to overcome the closing of borders and the resultant isolation, as well as a lack of LAN tournaments. Only three clubs from the end of 2017 — that’s the time of ELEAGUE Major: Boston 2018, which Cloud9 won — have survived to this day.

Almost all the players from those squads are no longer part of CS esports. Some finished their careers, others switched disciplines. Today, there are only two clubs from North America among the world’s top 30 teams. As for the top 10, the region’s presence there amounts to zero.

We are only stating the obvious: over the span of three years, North American Counter-Strike went from a Major championship all the way down to the brink of extinction. It’s time to get to the bottom of this sad situation.

Popularity of CS:GO in the U.S.

The first and arguably the main reason is the game’s relatively low popularity in North America, specifically in the United States. Consoles are extremely popular in the country. Many players simply don’t see the point of playing CS when there’s an XBOX or a PS with the new Halo or Call of Duty installed.

As a result, console shooters gather both more players in matches and more broadcast viewers. That said, Counter-Strike: Global Offensive, which only exists on the PC, isn’t exactly in the most favorable position. The poor popularity of the game led to the next reason for the downfall of American CS.

Tournament-related difficulties

If you look at North America-based IEM tournaments, there’s a clear-cut pattern. All tournaments that accepted teams from any region featured European teams. There’s more: it was clubs from the Old World that won over half of the titles.

For one, it wasn’t surprising to see two European squads in the finals of IEM XII Oakland. This international character of tournaments contributed to their popularity. Yet when the borders closed, these events grew less popular and profitable as expected.

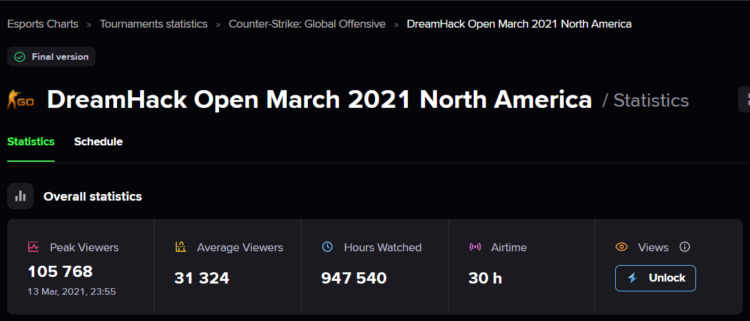

Let’s illustrate this with the example of DreamHack Open March 2021. Eight teams, a $70,000 prize pool, GSL group format, and four-team playoffs. The event was notably attended by the current best US team — Team Liquid. By the way, BLAST Premier: World Final 2021 will be the last tournament for the squad’s current lineup. Afterward, one of its former players will rejoin his original team 🙂

Given the scale of this event, its stats are pretty good. Over 100,000 spectators at peak; 30,000 on average per broadcast. However, one particular fact spoils the idyll these numbers seem to represent: two-thirds of the viewers were watching the Portuguese stream, not the English one. It was mostly dwellers of South America that the North American DreamHack attracted.

Just a month later, the CBCS Elite League tournament followed. A prize pool of $19,000, teams from South America, and an average of 45,000 viewers per broadcast! Stats that are 50% higher — for less money.

Needless to say, North American tournaments aren’t particularly profitable. Obviously, it’s much more lucrative to host an event elsewhere.

Valorant taking over

North American CS:GO probably could have survived this decline without too much trouble. But Valorant caused a monstrous drain of players on the pro scene. Once a week — or even more often — one top American player would announce he was leaving CS for the new game.

Riot Games, the developer and publisher of the game, is trying its best to maintain and enlarge the pro scene in North America. The company has already pulled off this trick with League of Legends, and now it seems to be working with Valorant as well.

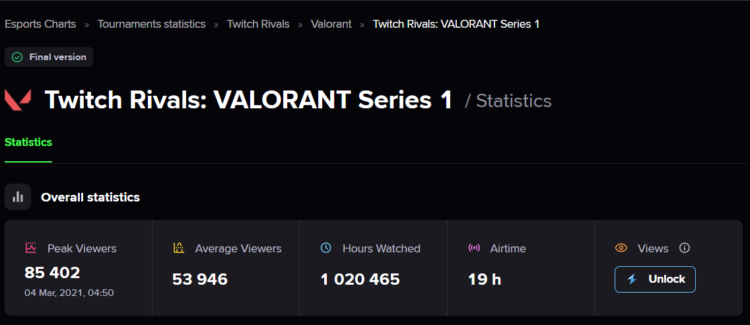

Let’s support our claims with some facts. Twitch Rivals: VALORANT Series 1 ended in March, and the day before this tournament’s finals saw the start of the above-mentioned DreamHack Open March 2021. Similarly, eight American clubs played in the VALORANT event. The prize pool was rather small, even smaller than that at DreamHack: $50,000. The only differences were the discipline and the format of the group stage and playoffs.

In terms of viewers, however, Twitch Rivals: VALORANT Series 1 was cooler by an order of magnitude. With comparable peak numbers — 85,000 viewers for Valorant vs. 105,000 for CS:GO — the former’s average number is much higher! On average, over 50,000 viewers were watching the spectacular fighting in Valorant. The bottom line here is self-evident: Twitch Rivals: VALORANT Series 1 scored more views with less time on air.

Moreover, the tournament at hand didn’t even feature teams with fan bases, simply gathering mixes of pro players and streamers! High-profile esports events attracted even more viewers.

The Major didn’t help

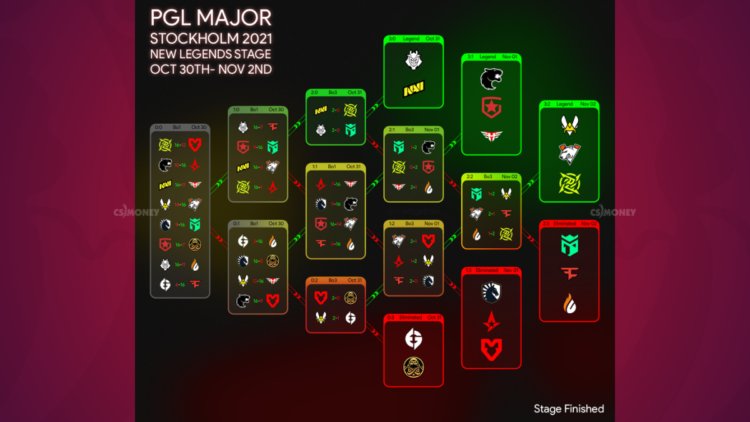

PGL Major Stockholm 2021 could have been a lifesaver for North American teams. Due to the RMR format, Team Liquid and Evil Geniuses not only made it to the tournament but also ended up straight in the Legends stage. Both clubs had secured their place in the top 16 long before their first match in Stockholm and had plenty of time to prepare.

But the results left little room for interpretation. Two teams — and only one victory combined between the two of them. Namely, Team Liquid beat ENCE on Dust 2 with a score of 16–8. As a matter of fact, it was indeed something of an achievement. At the time, ENCE was one of the world’s top 10 teams according to HLTV.

The rest of the matches were even direr: the North American teams struggled to win ten rounds in a game. Against this backdrop, the aforementioned South American teams looked invincible: FURIA Esports made the playoffs! While this certainly wasn’t the “Brazilian Finals,” one can still see just how devastating the pandemic-related restrictions came to be for teams from the U.S. and Canada alike.

Can Valve save the day?

No. The company has shown, on repeated occasions, that it only interferes in esports when absolutely necessary. Normally, the esports ecosystem tries to handle crises on its own. It’s a simple and understandable stance. For the North American pro-scene though, it means that tournament operators and teams there shouldn’t expect help.

Already we can talk about the region’s pro scene rolling back to the level of five or seven years ago. That’s right, back to the days when Team Liquid had to sign s1mple, a young and promising star from the CIS, to raise the overall caliber of their roster. Funnily enough, this time the team signed the experienced and successful Brazilian captain FalleN from another region.

North American CS isn’t dead yet, but it sure is on the verge of dying. The pandemic, the isolation that followed, the tournament deficiency, a lack of support from Valve — this perfect storm made esports in North America go to the dogs. The big question is: how many years will it take for it to recover?

If you enjoyed this post, be sure to subscribe to our newsletter. The subscription box is right there below — just leave your address and wait for emails. In them, we’ll tell you about the most exciting stuff on the blog, making sure you never miss our fantastic posts.

Do you like getting CS:GO news in our vibe?

What are you waiting for? Hit subscribe!